$418,600 pension for former CalPERS investment manager largest ever, new data show

In 2018, Curtis Ishii announced that he would be stepping down as head of global fixed income for the California Public Employees’ Retirement System (CalPERS).

Today, Ishii is collecting a $418,608 annual pension from the system, which is by far the largest of the more than 700,000 pension checks CalPERS issued last year, according to just-released pension payout data from TransparentCalifornia.com.

Ishii’s pension is nearly $50,000 greater than the $372,280 received by former Solano County administrator Michael Thomas, who had previously been the system’s top pensioner since retiring in 2011.

It also marks the first time that a CalPERS pensioner has legitimately broken the $400,000 mark. Former Vernon city manager Bruce Malkenhorst once collected a $551,000 pension, but CalPERS would later drastically reduce that amount and demand repayment due to illegal pension spiking.

Other notable new pensions added in the 2019 update include:

- Former Rubidoux Community Services General Manager David Lopez, who is now drawing a $307,787 annual pension.

- Former San Diego State University Dean Joyce Gattas, who is now drawing a $267,712 annual pension.

- Former Santa Clara Chief Electric Utility Officer John Roukema, who is now drawing a $258,472 annual pension.

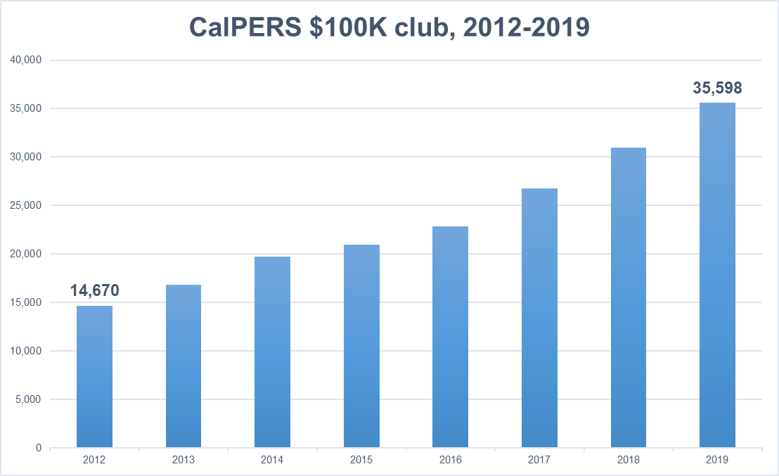

CalPERS $100K Club Up 15%

The new 2019 data reveal that CalPERS issued 35,598 pension checks that were worth $100,000 or more on an annualized basis last year — up 15 percent from last year’s report and 143 percent from 2012:

When excluding partial benefits paid out to beneficiaries, the average full-career pension for safety officers was $100,155 last year. Non-safety employees received an average full-career pension of $65,855.

There were 740 Oakland city retirees receiving a pension worth $100,000 or more — the most of any city statewide. Long Beach (533) and Anaheim (431) ranked 2nd and 3rd, respectively, among cities enrolled in CalPERS. To view the data sorted by individual city or other employing public agency, please click here.

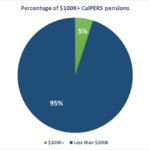

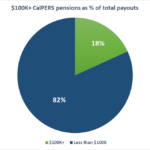

The number of $100,000 or greater pensions continues to grow both in raw terms and as a percentage of total outlays. While only 5 percent of pensioners are collecting annual pensions of $100,000 or more, these 5 percent account for 18 percent of total annualized pension payouts.

The growing number of $100K-plus pensions reflects an increase in newer retirees who benefited from the pension enhancements passed in 1999 and 2001. As documented by reporter Ed Mendel of Calpensions.com, CalPERS advocated for these enhancements by falsely claiming that they would not cost “a dime of additional taxpayer money.”

In reality, these enhancements are part of the reason why governments across the state are now struggling under the weight of soaring pension costs.

The complete 2019 CalPERS dataset is now available in a searchable and downloadable format at TransparentCalifornia.com.

Transparent California will be continually updating the site with new 2019 pension and pay data in the coming weeks. Be sure to follow our Facebook and Twitter accounts, sign up for our mailing list, or subscribe to our blog in order to receive the latest updates.

For more information, please contact Robert Fellner at 559-462-0122 or Robert@TransparentCalifornia.com.

Transparent California is California’s largest and most comprehensive database of public sector compensation and is a project of the Nevada Policy Research Institute, a nonpartisan, free-market think tank. The website is used by millions of Californians each year, including elected officials and lawmakers, government employees and their unions, government agencies themselves, university researchers, the media, and concerned citizens alike. Learn more at TransparentCalifornia.com.