Alameda County Transportation Commission Data Collection Success!

Transparent California’s mission is to get data covering every public employee in our state – millions of them from thousands…

Honesty in Public Employee Compensation Analysis

The Economic Policy Institute recently released its annual study of public teacher compensation and, to almost no one’s surprise, the…

San Bernardino Voters Pay the Price for Official’s Neglect of Open Records Law

San Bernardino taxpayers must now foot a $75,000 bill following a ruling in a recent public records case. The ruling…

A New Initiative to Transform California Open Records

Since its signing in 1968, California’s open records law has been the gold standard for government transparency. It has remained…

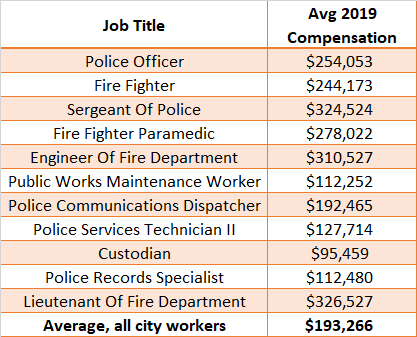

Los Angeles FD Payroll is Raging Out of Control

There is no doubt that firemen provide an essential service, and we owe it to our public servants to provide…

Don’t be Fooled by Teachers Unions’ Antics

Los Angeles Unified School District employees are again in an uproar and on strike. But it’s not poor academic performance,…

How Much are California K-12 Employees Really Paid – Benefits

In this series we’ve done an in-depth dive into Transparent California’s pool of compensation records, with actual data on how…

A New Way to Fight for California Transparency

The Sponsor a District Program, which is live right now on TransparentCalifornia.com, allows you to directly fund the collection of…

Support Transparent California

Subscribe to the Newsletter

Stay Informed

Sign up to receive the latest news and updates by email.