Full-career retirees comprise 19% of CalPERS membership, receive 38% of benefits

On our website, viewers can see the average full-career pension by employer for CalPERS or any other public pension plan in California. We define a full-career as those with at least 30 years of service credit upon retirement.

Just as one wouldn’t use the earnings of part-time workers to assess the salaries offered by a firm, it is necessary to look at full-career retirees when trying to gauge the level of retirement income provided by CalPERS.

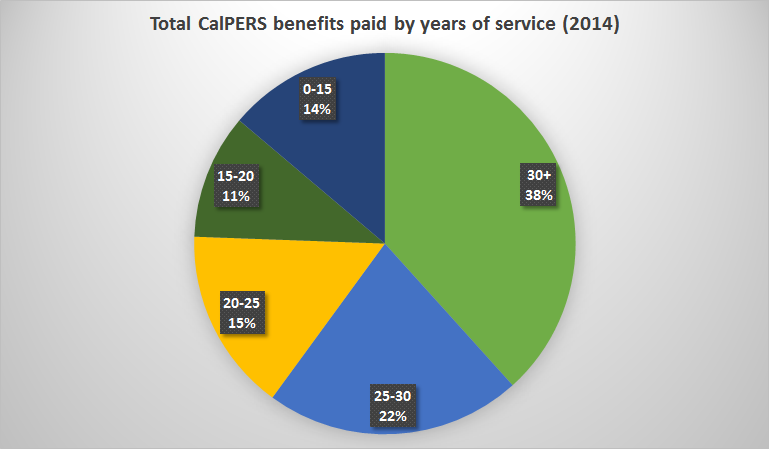

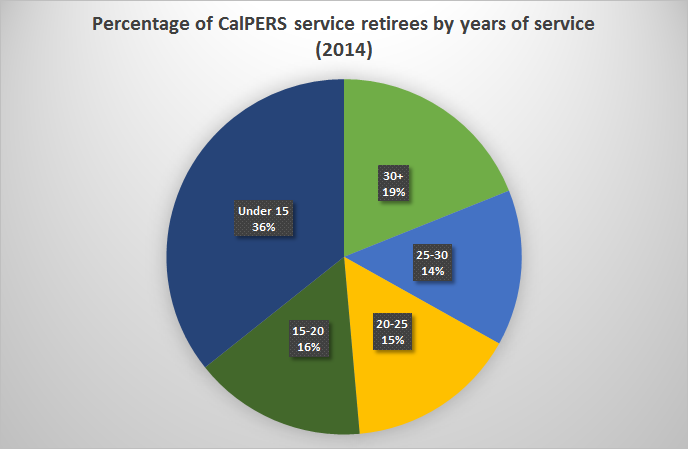

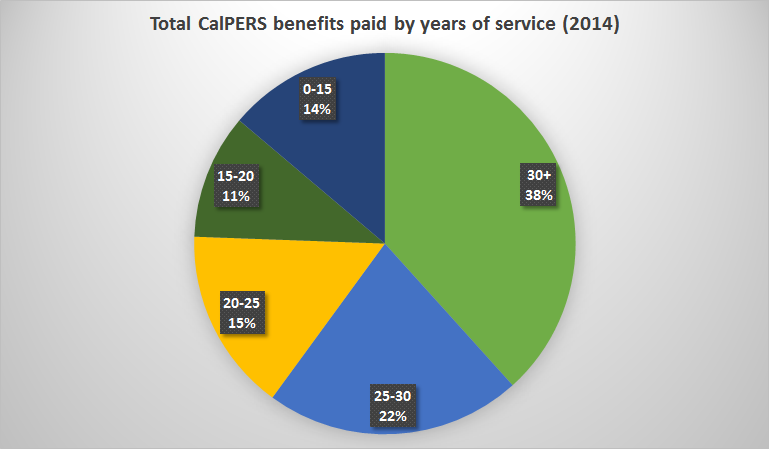

Another reason that full-career retirees deserve the most attention is because that is where most of the benefits are flowing to, as demonstrated by the two pie charts below:

As can be seen in the chart above, most CalPERS retirees worked for less than 20 years, which produces an average $2,784 monthly benefit — $33,408 annualized — cited in CalPERS facts at a glance and elsewhere in the media.

Despite accounting for only 19% of all service retirees, however, full-career retirees receive 38 cents of every dollar CalPERS paid in benefits last year. Retirees with at least 25 years of service represented 33% of total membership but received 60% of all benefits paid.

Given full-career retirees represent the lion’s share of CalPERS liabilities, there is even more reason to have accurate data on their benefits.

Full-career retirees received an average $5,489 monthly allowance, which is $65,868 annualized. An annuity providing the same level of income from Fidelity Investments would cost roughly $1.43 million.

The true level of retirement income provided by CalPERS is successfully hidden from public view, in part, by the 36% of membership that retire with less than 15 years of service credit and, accordingly, receive much smaller levels of retirement income than those who work a full-career.

The fact that there are nearly two retirees in the 0-15 bracket to every full-career retiree pushes the average dramatically lower and serves more to reflect the composition of CalPERS members — many have very short careers — than to provide a meaningful gauge of the level of retirement income offered by the system.

Using raw averages is particularly misleading given the back loaded nature of CalPERS benefits, which are designed to provide disproportionately larger sums for full-career retirees than partial-career retirees.

On this point, scholars at the Brookings Institution wrote that:

Those who leave their jobs earlier forgo a significant portion of the retirement benefits from their employer. This is because most pension systems provide very steep rewards late in employees’ careers, penalizing those who work for the state for “only” 10 or 20 years.

Understanding the drivers behind CalPERS’ single greatest expense — paying benefits owed to full-career retirees — is vital to anyone concerned with its financial health.

Robert Fellner is research director for Transparent California.

From a taxpayer pension standpoint, it doesn’t much matter whether a CalPERS job is filled by one 30-year employee, three 10-year employees, or any other permutation. Here’s why.

Let’s assume a pension for a firefighter is $90,000 if he/(occasionally she) is a full career 30-year employee. If that slot is instead filled by three 10-year firefighters over that 30 year span, that would constitute roughly three $30,000 pensions — totaling the same $90,000 a year upon retirement.

Indeed, short term employees could cost taxpayers significantly more, if they qualify for subsidized retirement health care for 10 years service. In that case our 3 ten-year employees would cost taxpayers for THREE retiree health care subsidies, rather than just one.

“In that case our 3 ten-year employees would cost taxpayers for THREE retiree health care subsidies, rather than just one.”

Excellent point, as usual!