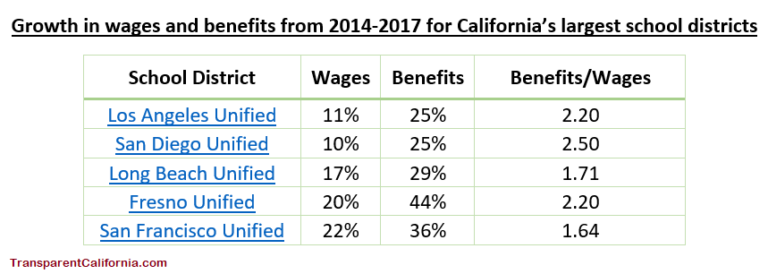

Growth in teacher pay dwarfed by soaring health, retirement benefits

A rapid rise in the cost of retirement and health benefits is dwarfing wage growth at many California school…

A rapid rise in the cost of retirement and health benefits is dwarfing wage growth at many California school…

For the fifth year in a row, Fire Captain Gregory Bradshaw has topped the overtime pay list at the…

The California Public Employees’ Retirement System (CalPERS) is unlawfully withholding information necessary to help safeguard the system from waste,…

The total pension benefits promised by the San Diego County Employees’ Retirement Association (SDCERA) increased 1,237 percent from 1986-2016…

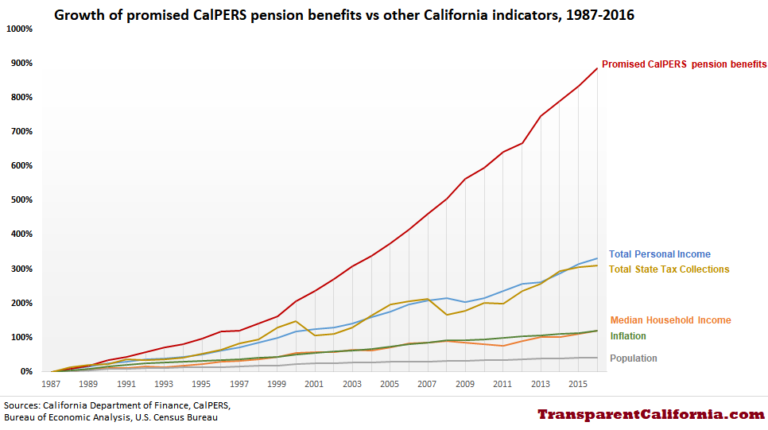

The total pension benefits promised by the California Public Employees’ Retirement System (CalPERS) increased 886 percent from 1987-2016 —…

Today, Transparent California — California’s largest public pay database — released previously unseen 2017 pay data for the City…

Overtime pay that was at least triple his regular salary in each of the past four years allowed Los…

Total employee compensation for San Jose city workers hit a record-high $1 billion last year, according to newly released…

Today, Transparent California — the state’s largest public pay database — released 2017 employee compensation data for 175 California…

Today, TransparentCalifornia.com released previously unseen 2017 pension data for the Los Angeles Fire and Police Employees’ Pension plan. This…