Dubious overtime pay helped boost former LA Port Pilot’s pension to nearly $375,000 a year

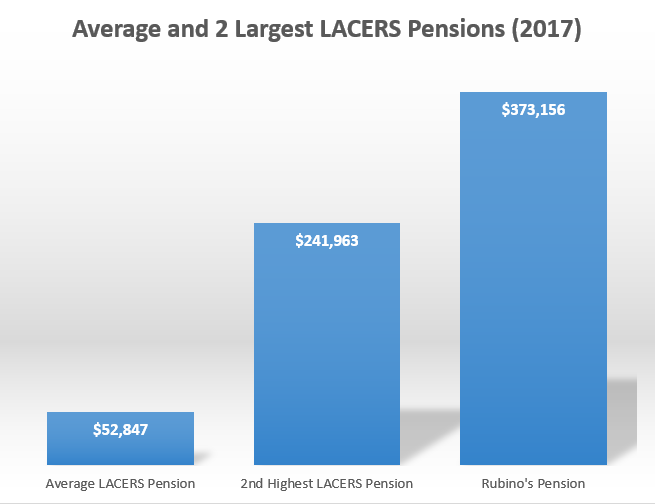

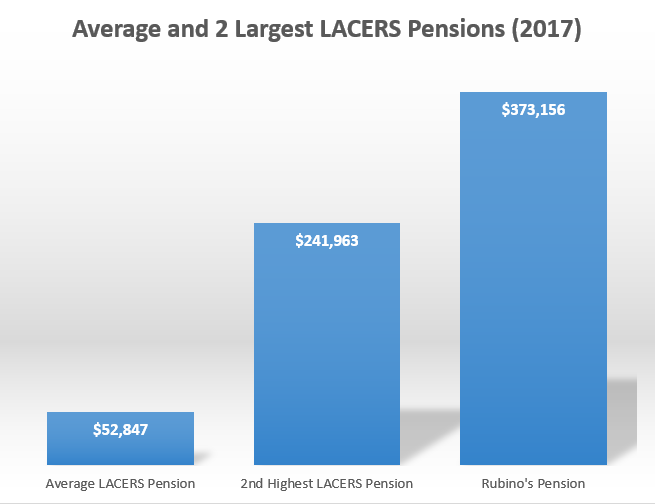

Former Los Angeles Chief Port Pilot Michael Rubino’s $373,156 annualized pension has shattered the record for the highest pension received by any member of the Los Angeles City Employees’ Retirement System (LACERS), according to just-released 2017 pension data posted on TransparentCalifornia.com.

Rubino’s pension is a staggering 54 percent larger than LACERS 2nd highest pension of $241,963, which goes to Margaret Whelan, the former general manager of the city’s personnel department who retired in 2014 after a 44-year career.

Whelan’s lengthy career meant she would receive a pension worth 96 percent of her final salary upon retirement. Rubino’s 30 years of service at retirement, by contrast, meant he was only eligible to receive a pension worth 66 percent of his final salary — which makes his outsized pension even more remarkable.

Understanding Rubino’s atypically large pension then requires understanding his final salary — which is the amount LACERS uses to calculate an employee’s future pension.

While Rubino’s base salary at the time of his retirement was around $300,000, his “final salary” was nearly $570,000.

There are two main factors that allowed Rubino to boost his final salary so far above his regular pay.

Dubious overtime pay

In addition to sizable bonuses port pilots receive based on the amount of cargo moved, their final salary can also be inflated through a special type of overtime pay known as “callback pay,” which, unlike regular overtime pay, counts towards an employee’s final salary and thus future pension.

In 2016, the Los Angeles Times exposed how callback pay at the port was being wildly abused, citing a practice whereby “pilots on callback collect overtime for roughly twice as many hours as they actually work, resulting in hundreds of thousands of dollars paid to them each year for time they weren’t on the job.”

And while their contract calls for chief port pilots like Michael Rubino to only get called back when “no other pilots are available,” Rubino was called back a staggering 137 times in just the 2016 fiscal year alone — which boosted his pay, and thus final salary, by nearly $90,000, according to the Los Angeles Times report.

Final Salary = highest one-year salary

Rubino also benefited greatly from LACERS practice of using an employee’s single highest year of earnings as their final salary, rather than the 35 years used by Social Security or the 3-5 years used in most other public pension plans.

Thanks in part due to the boost from callback pay mentioned above, the $580,000 in wages Rubino received in 2016 — his final full year before retirement — was over $100,000 greater than any of the preceding years, and was $210,000 more than his 2012 earnings, according to a review of historical pay data on TransparentCalifornia.com.

Thus, LACERS policy of using the single highest year of earnings for an employee’s “final salary” was particularly beneficial to Rubino, who saw a roughly $75,000 increase to his annual pension as compared to what he would have received if LACERS used the average of an employee’s five highest years of earnings to calculate final salary.

Rubino is a particularly stark example of how California’s public pensions are functionally a wealth maximization program, according to Transparent California Executive Director Robert Fellner.

“For a state dedicated to representing so-called ‘progressive’ values, California’s public pensions are anything but. The system provides enormous benefits to those already earning some of the highest salaries in the state, while providing lower wage workers — and thus those genuinely in need of retirement security — with much less.”

The average LACERS recipient had 28 years of service credit at retirement and received a benefit of $52,847 — which represents a 34 percent increase since 2012.

To view the entire 2017 LACERS dataset in a searchable and downloadable format, please visit TransparentCalifornia.com.

Transparent California will be continually updating the site with new, 2017 data from the remaining pension funds in the coming weeks.

Be sure to follow our blog and Twitter accounts, or sign up for our mailing list, in order to receive the latest updates.

For more information, please contact Robert Fellner at 559-462-0122 or Robert@TransparentCalifornia.com.

Transparent California is California’s largest and most comprehensive database of public sector compensation and is a project of the Nevada Policy Research Institute, a nonpartisan, free-market think tank. The website is used by millions of Californians each year, including elected officials and lawmakers, government employees and their unions, government agencies themselves, university researchers, the media, and concerned citizens alike. Learn more at TransparentCalifornia.com.