It’s Sunshine Week in California!

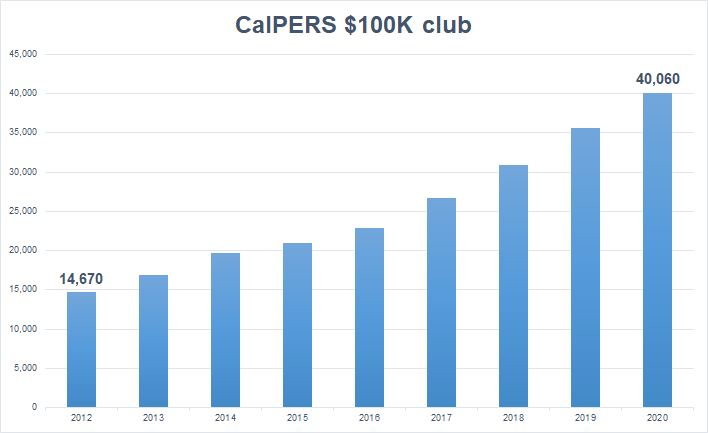

From 2020 to 2021, the average total pay and benefits has risen from $120,892 to $126,688, an increase of 4.8%. …

Transparent California Says Hello to Sunshine Week

Each year, Transparent California is proud to take part in a national celebration of government transparency known as Sunshine Week….

A Major Milestone for Transparent California!

Transparent California is honored to announce that we have achieved our 400 Millionth Pageview! This major milestone represents the generous…

California Superintendent Salaries Continue to Rise

Transparent California’s own Todd Maddison was quoted in a recent article by the San Diego Union Tribune on the highest…

How Much are California K-12 Support Staff Really Paid?

Claims are often made that support staff should be paid more, but those claims are rarely accompanied by data justifying…

City of Compton Sued for Public Records Law Violation

December 2022 update: In response to our lawsuit, the City promptly provided all of the requested public records and paid…

How Much are California K-12 Administrators Really Paid?

We often hear how choosing to be in education means taking a vow of poverty and making great sacrifices in…

How Much are California K-12 Teachers Really Paid?

The California Assessment of Student Performance and Progress shows only 52 percent of students meet or exceed standards in English, and…

Support Transparent California

Subscribe to the Newsletter

Stay Informed

Sign up to receive the latest news and updates by email.