A Win for California Transparency!

Alameda County Superior Court Judge Michael Markman has ruled that the CalPERS Board of Administration violated California’s open meetings…

Alameda County Superior Court Judge Michael Markman has ruled that the CalPERS Board of Administration violated California’s open meetings…

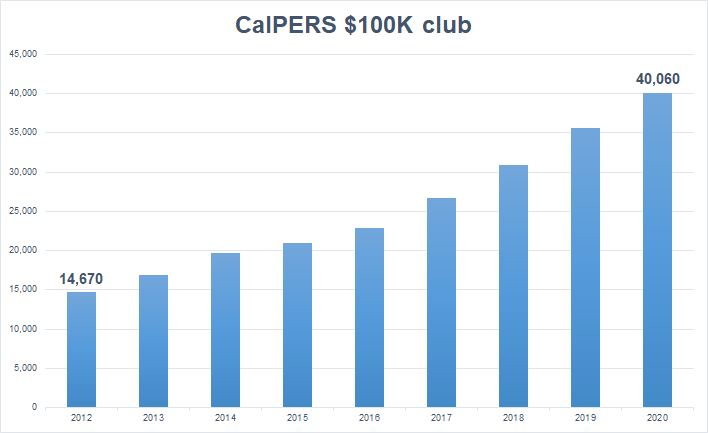

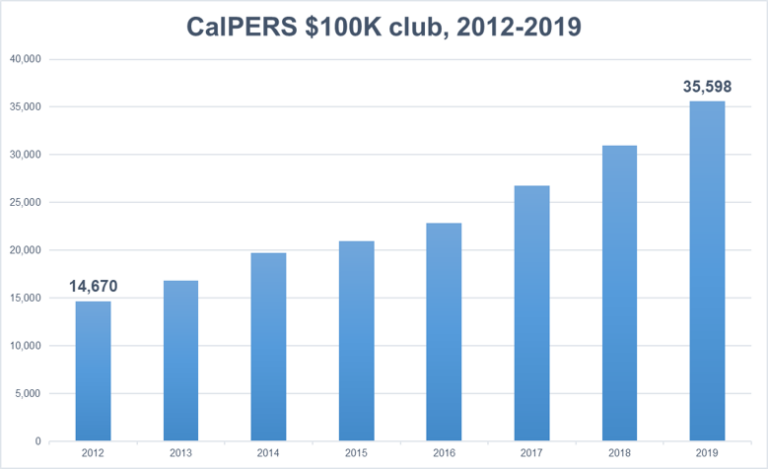

CalPERS issued 40,060 pension checks that were worth $100,000 or more on an annualized basis last year — up…

Our public records lawsuit against CalPERS was recently dismissed by the 3rd District Court of Appeal. (If you are…

An excellent article on our CalPERS lawsuit was published today by the Orange County Register. The article puts the…

Today, Transparent California filed its opening appellate brief in its ongoing public records lawsuit against the California Public Employees’…

In 2018, Curtis Ishii announced that he would be stepping down as head of global fixed income for the…

In an op-ed for today’s San Diego Union-Tribune, I describe how the recent court ruling in our CalPERS lawsuit will be…

It is going to be much easier for governments to hide their affairs from the public, if the legal…

Yves Smith of the Naked Capitalism blog has presented irrefutable evidence that CalPERS CEO Marcie Frost submitted false information…

The California Public Employees’ Retirement System (CalPERS) is unlawfully withholding information necessary to help safeguard the system from waste,…