Turlock takes steps to address soaring health costs

Today’s report from the Turlock Journal has the details: The Turlock City Council voted to implement contracts with the…

Today’s report from the Turlock Journal has the details: The Turlock City Council voted to implement contracts with the…

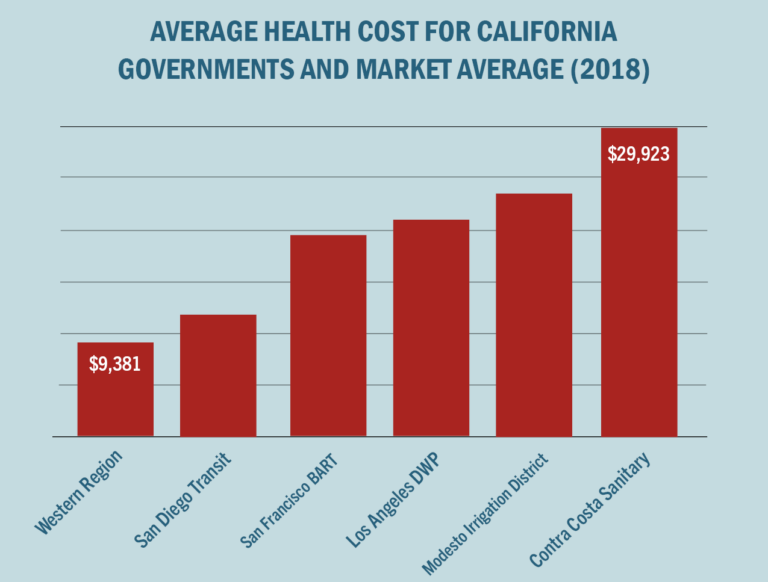

Spending 52 percent more than the market average for public employees’ medical insurance is costing California taxpayers at least…

The Los Angeles News Group published a report on our data revealing astronomical levels of health costs for city…

Transparent California was featured in the Contra Costa Times and the OC Register today! From the Contra Costa Times…

Executive Summary The price of health insurance in America has consistently risen faster than the rate of inflation and,…

Despite the warning from the Government Accountability Office (GAO) of the impending burden to state and local governments from rising healthcare costs, many…