Voters Deserve the Truth on Pension-Driven Tax Hikes

Washington Examiner — Jan. 22, 2020 Soaring public pension costs are driving a wave of tax hikes across California,…

Washington Examiner — Jan. 22, 2020 Soaring public pension costs are driving a wave of tax hikes across California,…

In an op-ed for today’s San Diego Union-Tribune, I describe how the recent court ruling in our CalPERS lawsuit will be…

Our recent report on California’s exploding $100K club has generated quite a bit of coverage, perhaps none better than the…

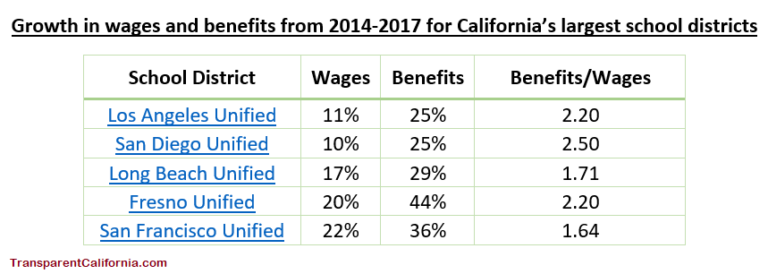

A rapid rise in the cost of retirement and health benefits is dwarfing wage growth at many California school…

A new rule currently being considered by the Actuarial Standards Board would finally require public pensions to meaningfully account…

The total pension benefits promised by Marin County increased 982 percent from 1986-2016 — a rate 58 times greater…

A great column by Jody Morales on the impact court rulings in 2018 might have for public pensions: Many…

In today’s Washington Examiner I highlight the unfair burden public pension plans impose on today’s teachers and students. A slice: CCSD…

A new op-ed published in the Vallejo Times-Herald highlights the devastating effects that the public pension crisis can have on…

Update 8/22/16: We have learned that the City of Larkspur adopted OPEB reforms earlier this year which were not reflected in…